India Soybean Industry Tackles With Seed Shortages and More Import Supplies

Reading time: 1 minute

This year, certified seeds have had less availability in the country. The possibility of shortage was estimated at more than 200,000 seed quintals, which is a matter of concern. Demand was 3,700,000 quintal soybean seeds in the “Kharif” season. Against this demand, only 3,500,000 quintal seeds were available.

Farmers usually store seeds with themselves for sowing, but the quality is not as good as certified seeds. However, farmers tended to buy seeds from other farmers and relied less on seeds prepared by private entities. Certified varieties are produced from foundation seeds derived from breeder seeds by agricultural scientists.

The main reasons for this are believed to be the decrease in production and productivity, the disillusionment of farmers, the incentive for farmers to take on other crops, and the rising prices of seeds and other agricultural inputs over the last few years.

A 30 kg seed bag costs Rs 3,900-Rs 4,350 against the 2021 price of Rs 2,250, mainly due to a rise in the demand and stocking by companies for producing cooking oil. The rates have jumped from Rs 125 to Rs 135 per kg now.

In the country, the soybean crop is mainly grown in Madhya Pradesh, Maharashtra, Rajasthan, Chhattisgarh, Gujarat, Karnataka, and Telangana. The average production is around 12,000,000 tons. Madhya Pradesh, the second largest province in territory size, contributes to about 45 percent of the output, followed by Maharashtra (40 percent). Soybean was sown over 14,765,000 hectares last year, and the production (according to the second estimate) is estimated to be 13,116,000 tons.

Downward price trend

A downward trend in Soybean prices can in the coming time. It may fall by up to Rs 6,000 per quintal. According to experts, the Soybean price in Indore has fallen to the lowest level in 4 months and continues to decline. Soybean is trading at around Rs 6,625 and could come down to Rs 6,000 and Rs 6,200. According to commodity researchers, there will be an upward trend in Soybean prices only when the price starts trading above Rs 7,300 per quintal. However, given the current circumstances, it appears complicated.

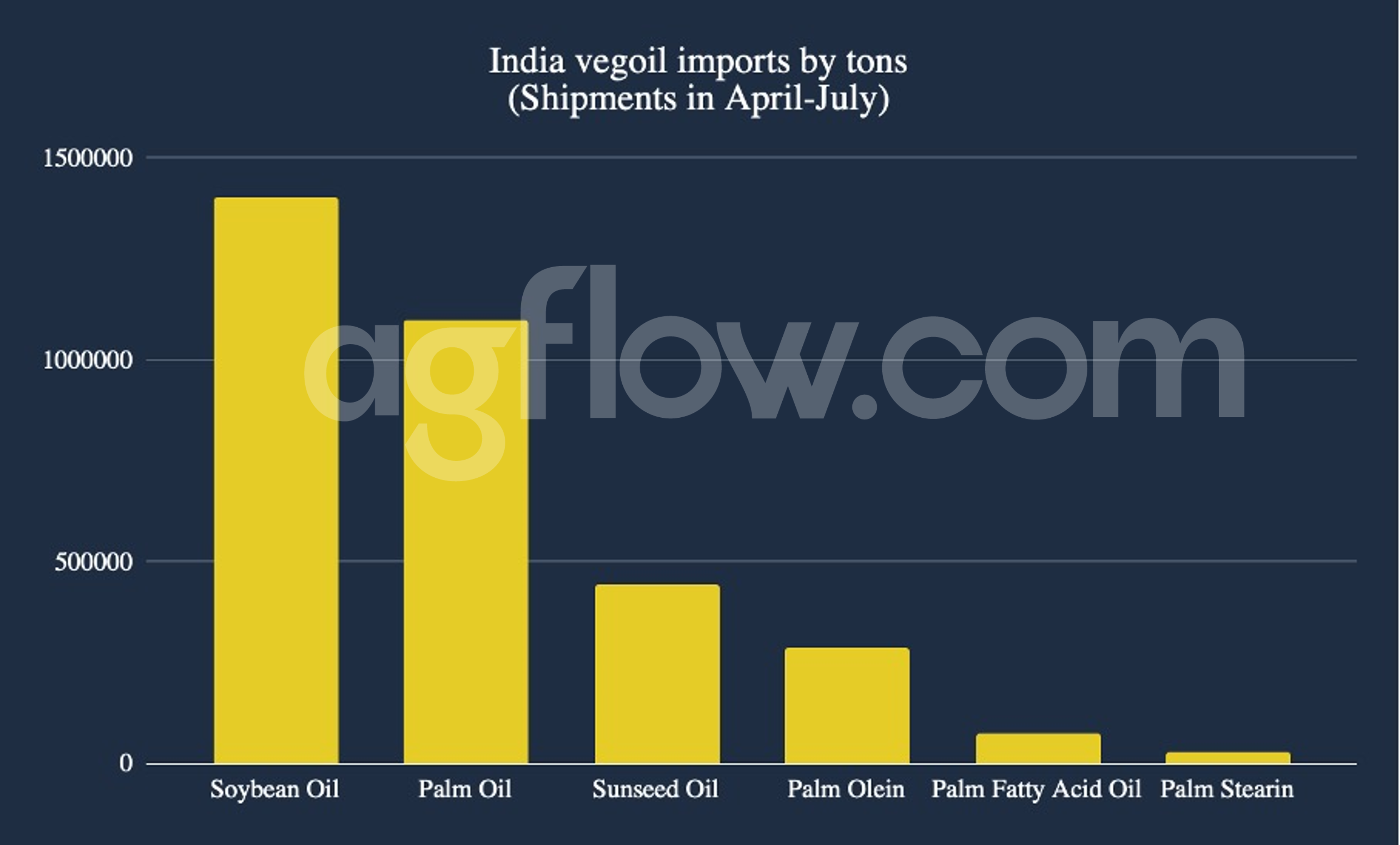

The reason for the downward trend is the abolition of import duty on Crude Soybean Oil and Sunflower Oil. So, more supplies of Crude Palm Oil (CPO) and Palm Olein are expected from Indonesia and Malaysia. According to the AgFlow data, Soybean Oil led the Vegoils import market with 1.4 million tons shipped between April-July, followed by Palm Oil, Sunseed Oil, Palm Olein, Palm Fatty Acid Oil, and Palm Stearin.

Apart from weak demand from millers and stockiests, weakness in international prices has also affected the price sentiments of Soybean. Soybean Oil demand will remain weak due to the disparity in the price of Soybean in comparison to Mustard Oil and CPO. As of July 26, according to the Indian Soybean Processors Association, the Indore city market prices of Soy Solvent Oil were Rs 1,185-1,190 per 10kg, Soy Refined Oil price was Rs 1,215-1,220 per 10kg, and Soybean Meal was Rs 49,000-51,000 per ton.

The decision taken by the government to reduce the price of edible oils will have an impact on the market. According to the notification issued by the Ministry of Finance, import duty will not be levied on 2,000,000 tons of crude soybean and Sunflower Oil in the financial years 2022-23 and 2023-24. The exemption is dedicated to cooling domestic prices and controlling inflation.

Free & Unlimited Access In Time